The AfCFTA and African Trade—An Introduction to the Special Issue

- DOI

- 10.2991/jat.k.211206.001How to use a DOI?

- Keywords

- AfCFTA; African trade; regional integration; intra-African trade; international economics

- Abstract

The agreement establishing the African Continental Free Trade Area (AfCFTA) has been attracting a great deal of attention in academic and policy circles, as well as within the international development community. The growing interest in the AfCFTA partly reflects the fact that the African continent is bucking a global trend toward greater protectionism. But it also represents a break with the past on a continent where market fragmentation has emerged as a major constraint to growth and economic development. The AfCFTA offers the opportunity to accelerate the transformation of African economies to boost intra-African trade and enhance integration of the region into the global economy. This paper introduces the Special Issue on ‘The AfCFTA and African Trade’. It provides an overview of the existing literature, explores the implications of the landmark agreement for African trade and economic development, and highlights some of the potential challenges associated with its operationalization.

- Copyright

- © 2021 African Export-Import Bank. Publishing services by Atlantis Press International B.V.

- Open Access

- This is an open access article distributed under the CC BY-NC 4.0 license (http://creativecommons.org/licenses/by-nc/4.0/).

1. INTRODUCTION

The agreement adopted by 54 African leaders in March 2018 establishing the African Continental Free Trade Area (AfCFTA) has been attracting a great deal of attention in academic and policy circles, as well as within the international development community.1 The growing interest in the AfCFTA partly reflects the fact that the African continent is boldly bucking a global trend toward greater protectionism (see, inter alia, Gunnella and Quaglietti, 2019; Fajgelbaum et al., 2020). It also represents a break with the past on a continent where market fragmentation has historically been seen as a major constraint to growth and economic development (Collier and Venables, 2008; Fofack, 2018; IMF, 2019) and offers the opportunity to accelerate the transformation of African economies and enhance their integration into the global economy.

This paper introduces the Special Issue on ‘The AfCFTA and African Trade’. It provides an overview of some of the existing literature and explores the implications of the continental trade integration agenda for African trade and economic development. We also highlight some of the potential challenges associated with the operationalization of the landmark agreement. The paper is structured as follows. Section 2 opens with an overview of the history of regional integration in Africa and then explores the links between integration and economic development. Section 3 focuses on the policy implications of the AfCFTA and reviews its political aspects, as well as the challenges associated with its implementation. The last section provides a brief overview of the articles contained in this Special Issue—the first ever devoted to the AfCFTA and African trade by an academic journal.

2. THE ECONOMIC RATIONALE OF THE AfCFTA

There are several channels through which allocative efficiency and accumulation effects associated with regional integration may boost overall economic growth and redefine the patterns of African trade during the AfCFTA’s implementation. Traditionally, trade integration is seen as a way to enable the specialization of countries in the production of goods and services for which they have a comparative advantage (Fosu, 1990; Arndt and Kierzkowski, 2001; Sala-i-Martin, 2007). However, traditional trade models based on the static Ricardian and Heckscher-Ohlin views of comparative advantage have been adapted to account for the rise of intra-industry trade and international specialization in components (Krugman, 1995; De Backer et al., 2018).

New dynamic comparative advantage models, which account for economies of scale and capital mobility, have been brought into the mainstream, reflecting the revolutionary nature of Global Value Chains (GVCs) and their contribution to economic integration. Advances in communication and transportation technologies have also opened new opportunities for developing countries (Baldwin, 2014; Kowalski et al., 2015; De Backer et al., 2018; Del Prete et al., 2018). Trade integration, widely understood, can thus help propel development and has been the vector of spectacular success stories in other parts of the world, the most notable examples coming from Asia, where the rapid expansion of Regional Value Chains (RVCs) and integration into GVCs has helped to sustain high rates of economic growth and accelerate income convergence (De Backer et al., 2018; Pomfret and Sourdin, 2018; World Bank, 2020b).

By contrast, the narrative on Africa’s secular decline in its share of world trade is well known—the continent’s share of global trade has fallen by about a third since 1970 (from about 4.5% to less than 3% in 2020), not at all commensurate with its share of the world population (Fofack, 2020; AfDB and Afreximbank, 2020).2 Formal sector intra-regional trade also remains low, sitting at around 18% of total African trade,3 in 2020 although as stressed by Mold and Chowdury (2021), the economic significance of intra-African trade is often underestimated, being masked by the proclivity of Africa’s largest economies to trade outside the continent, by the high degree of informality of cross-border African trade,4 and the predominance of a few commodity exports in total trade.

It is in fact precisely this excessive dependency on primary commodities, combined with the highly extroverted nature of African trade, that has magnified the region’s exposure to global volatility. According to the most recent biennial Commodities and Development Report 2021 from the United Nations Conference on Trade and Development, 45 African nations are commodity-dependent—a tally that has hardly changed from the end of the colonial era (UNCTAD, 2021). Structural challenges related to the lack of value-addition to commodity exports (Morris et al., 2012), the perceived stagnation of the manufacturing sector, and the disproportionate growth of low value-added services have all compounded the developmental challenges (McMillan et al., 2014; Cilliers, 2020). These factors are also largely responsible for the recurrent balance of payment crises that undermine growth prospects and exacerbate macroeconomic management challenges across the region (Brixiova et al., 2015; Fofack, 2015) and remind us of the importance of accelerating the economic diversification of the continent.

Some authors (e.g., Rodrik, 2016; Gelb et al., 2020) have even suggested that the continent may have missed the proverbial boat in terms of achieving an acceptable degree of industrialization—because of underlying changes in the global economy, it is argued that the window of opportunity has now closed and the continent is undergoing a process of relative deindustrialization. Others highlight the difficulties the continent has had in integrating into GVCs (Conceiçao et al., 2014; World Bank, 2020a).

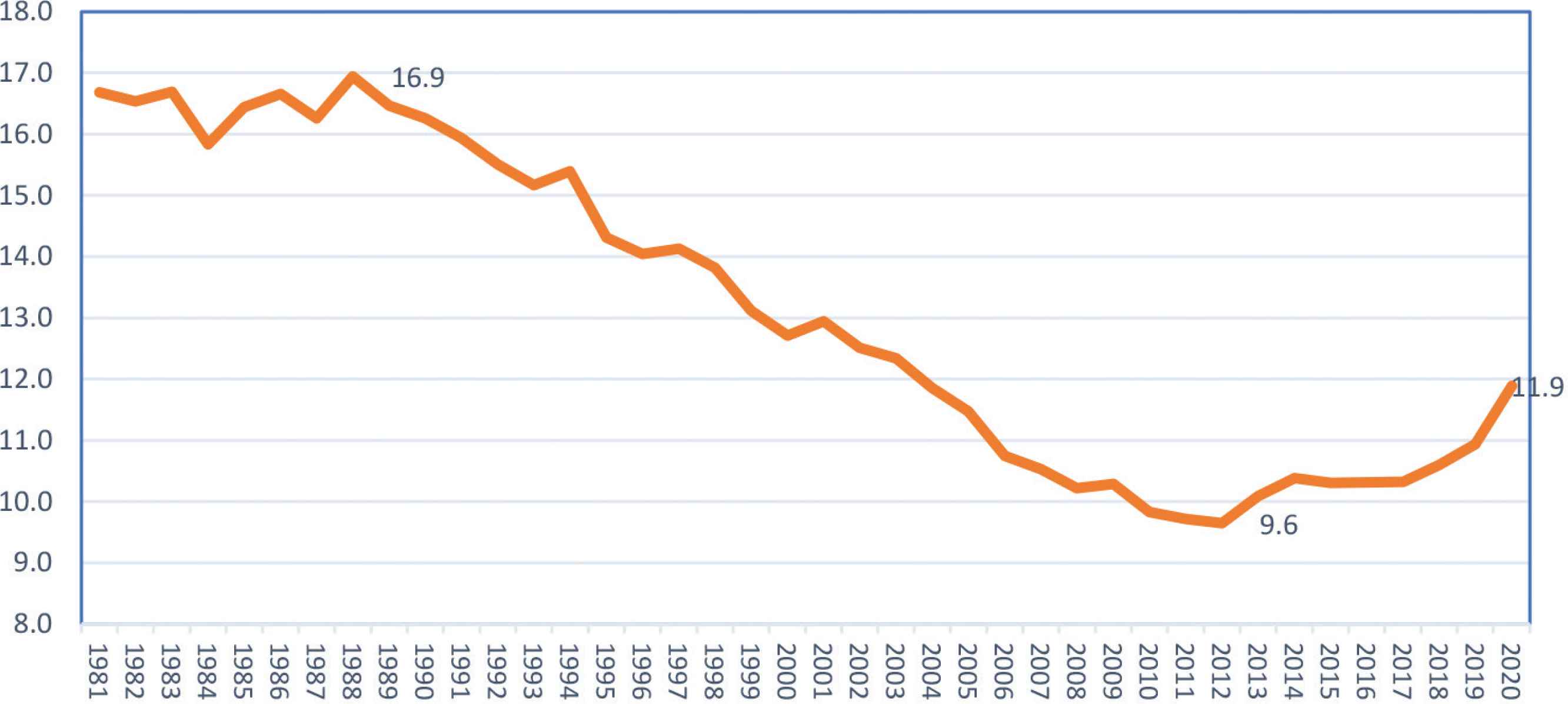

We do not share such pessimistic interpretations, for various reasons. Firstly, there is growing evidence of a revival in the fortunes of African manufacturing, building a base upon which the AfCFTA can thrive. The long decline in manufacturing’s share of GDP since the period of structural adjustment (Fofack, 2014) has bottomed out, and for sub-Saharan Africa it stands at around 12% of GDP, having dipped below 10% around the time of the global financial crisis of 2008–9 (Figure 1). Far from languishing, the sector’s output is up 91% in real terms since 2000 (Kruse et al., 2021).5 Though admittedly starting at a lower level, that growth is impressive, especially after adjusting for income and population.

Manufacturing value added as percentage of GDP, sub-Saharan Africa, 1981–2020. Source: WDI (2021).

Secondly, simulations using either Computable General Equilibrium (CGE) or gravity models (e.g., Saygili et al., 2018; IMF, 2019; World Bank, 2020a, 2020b; Fofack et al., 2021) lend strong support to the idea that liberalizing trade and investment under the AfCFTA will significantly boost these efforts toward economic diversification. Manufactured goods dominate intra-African trade, which is set to expand markedly during the AfCFTA’s implementation (see UNCTAD, 2019; Songwe et al., 2021). The agreement’s impact on intra-African trade is expected to be even more pronounced if the elimination of tariffs on 97% of existing intra-regional trade flows is supplemented by enhanced trade facilitation measures and policies addressing non-tariff bottlenecks to formalize informal cross-border trade (UNCTAD, 2019; Afreximbank, 2020).

Thirdly, the AfCFTA has the potential to deepen and create new, more competitive RVCs, as well as to facilitate the emergence of more resilient supply chains to accelerate industrialization (Stiglitz, 2018; WEF, 2021). While African nations mostly participate in GVCs through forward rather than backward activities (de Melo and Twum, 2021), the increasingly favourable environment for foreign investment and lower trade barriers associated with the AfCFTA should accelerate the development of RVCs. This, in turn, could enhance the participation of African countries beyond the provision of raw materials for extra-regional value chains and more toward end-market upgrading. Moreover, the harmonization and shift toward more homogeneous rules-of-origin under the AfCFTA should strengthen backward linkage effects to further accelerate the development of RVCs (Tsowou and Davis, 2021; Signé and Madden, 2021).6 Some underlying global trends also militate in favour of this outcome:

- •

The reordering of global supply chains during the Covid-19 pandemic has been a catalyst toward the regionalization of certain GVCs (Gereffi, 2020; Zhan, 2021). That momentum is likely to increase after the pandemic, especially in industries where maintaining resilient supply-chain flows matters as much as cost and efficiency. These RVCs will be shorter and less fragmented (Pla-Barber et al., 2021) and could play a key role in further greening the AfCFTA whose carbon footprint is already low, as argued by Bengoa et al. (2021).

- •

In the face of growing public pressure and alarm, environmental considerations are becoming increasingly paramount, and there will be pressures to reduce the trade-intensity of value chains, particularly in intermediate goods (Fernandez de Cordoba and Lambert, 2020). This again tips the balance in favour of a more regional approach to value-chain development (AIIB, 2021).

- •

Finally, compared with the ageing population in other parts of the world, Africa’s market size and demographic trajectory will increasingly lure investors to cater for the burgeoning consumer market. Albeit starting from a low base, income levels in Africa have already started to rise substantially, with household consumption projected to grow by an impressive 3.8% to reach nearly $2.1 trillion per year by 2025.7

Fourthly, the AfCFTA has the potential to transform the region’s productivity and competitiveness landscape (Fofack, 2018, 2020; IMF, 2019). Under the agreement, companies will increase investment and draw on economies of scale to transition away from natural resources toward more labour-intensive manufacturing industries. Together with the 2012 Action Plan for Boosting Intra-African Trade (BIAT),8 expected productivity gains and higher returns on investment will enhance investors’ confidence and growth prospects within the region, as well as accelerate the diversification of sources of growth and change the patterns of trade.

Finally, the AfCFTA has the potential to significantly boost the growth of services trade. Services trade in Africa has been growing rapidly over the last two decades and has now reached more than a quarter of the value of merchandise exports. Services have a strong intermediate role and have both a direct effect themselves and indirect contribution, through the servicification of production, to value added in other sectors, such as manufacturing, mining and agriculture. They will play an even more important role during the implementation of the AfCFTA, sustaining the rise of cross-border trade and the expansion of RVCs.

An example has been the rapid growth of African retail chains (Signé, 2020). South African supermarket chains, in particular, have spread over Southern, East and West Africa. Four supermarket chains (Shoprite, Pick n Pay, Spar and Massmart) already had 554 stores outside of South Africa by 2016. Although these stores are still mainly supplied with products from South Africa, local supply is steadily increasing, and regional governments are pressurizing the supermarkets to expand the domestic supply from local firms and farms. The expansion of these supermarket chains into the rest of Africa also creates the potential for regional supplier upgrading, as well as regionally supplying the South African market (Kaplinsky and Morris, 2019).

This leads us to a dimension that is often missing in discussions on the AfCFTA—how it will impact on inflows of Foreign Direct Investment (FDI), both from within the continent and outside. Although African FDI has been relatively low compared with other regions, empirical evidence shows that joining a free trade area could boost FDI inflows by around a quarter (Blomström and Kokko, 2003). Across the continent, the magnitude of the correlation between investment and trade will be magnified by the deepening process of integration, which is set to disproportionately boost intra-African trade and play a key catalytic role in attracting FDI.

An encouraging example of emerging patterns of FDI is the automotive industry. After Volkswagen established a car manufacturing plant in Rwanda, Peugeot and Opel have established a plant to assemble up to 5000 cars per year in Namibia (WEF, 2021). Ghana too has attracted car-assembly plants from Nissan and Volkswagen. Morocco has been extremely successful in developing its car industry, surpassing South Africa in terms of export values (worth US$10 billion in 2019)—while the bulk of its exports (around 80%) is oriented toward Europe, it is increasingly selling cars to its domestic and regional markets and has an eye on the West African market. The presence of companies such as Valeo of France, Varroc Lighting Systems of the US and Yazaki and Sumitomo of Japan shows that Morocco has had some success in forcing a backward integration of the industry, by stipulating the use of locally-based suppliers (Pilling, 2021). Developments like these augur well for the desired shift in the composition of FDI away from primary commodities and natural resources toward higher-value-added activities and the emergence of RVCs.9

Besides raising the capital stock, larger inflows of FDI can also be an important source of technology, demonstration effects and competition (Caves, 1974; Rasiah, 1995; Paul, 2016). Consistent with historical trends, the AfCFTA will catalyze technology transfers, especially as firms from more advanced economies seek to reap the growth opportunities of higher returns on investment associated with expanding economies of scale and diversification of sources of growth across Africa.10 For instance, technology transfer has greatly benefitted countries that are members of the Association of Southeast Asian Nations (ASEAN) Free Trade Area and was a key component of regional production networks set up by multinationals to promote intra-regional division of labour through the fragmentation of the production process into different sub-processes located in different countries across Asia (Lowitt, 2011; Rodrik, 2018).

The AfCFTA can help African nations achieve similar results, reducing the correlation between commodity price cycles and growth and setting countries on a long-run growth trajectory.11 Eventually, and as the AfCFTA catalyses the development of RVCs to integrate GVCs, the dynamics of current accounts across the region will no longer be dictated by commodity prices, but increasingly by the linkage between trade, regional and international production.

3. THE POLICIES AND POLITICS OF THE AfCFTA

The AfCFTA has been decades in the making. Deepening political and economic integration was the basis for the establishment of the Organization of African Unity, the precursor of the African Union (AfDB, 2000; ECA, 2004). The Lagos Plan of Action for the Economic Development of Africa, developed in 1980, and the Abuja Treaty, which provided the framework for establishing African Regional Economic Communities (RECs) in 1991, were also important milestones:12 They laid out the roadmap toward the long-standing goals of African economic and monetary union, the final stage in a six-step process13 intended to foster integration in a continent where regional integration has been seen not only as a means for accelerating and consolidating economic and social development but also as an end in itself.14 As Fofack (2014: 284) notes,

‘the common thrust of these African-led development frameworks is the emphasis on self-reliance…self-reliance does not, however, mean that Africa should embrace autarky as a development strategy. Instead, it implies that external support should not be the mainstay of African development, but rather a boost to existing endogenous efforts. After all, economic growth, which is necessary though not sufficient for development, depends on trade and investment, both domestic and foreign investment.’

The AfCFTA treaty is quite specific about the fact that the existing RECs will constitute building blocks for the implementation of the continental agreement.15 Yet it needs conceding that the track record of Africa’s RECs has been mixed (Oyejide et al., 1997; AfDB, 2000; ECA, 2006). Part of the underperformance is explained by the piecemeal integration of goods, labour and capital markets (Hartzenberg, 2011; UNCTAD, 2015), something which the AfCFTA is expressly intended to address. Moreover, it would be wrong to underestimate the important groundwork for the AfCFTA already undertaken at the REC level, for several reasons.

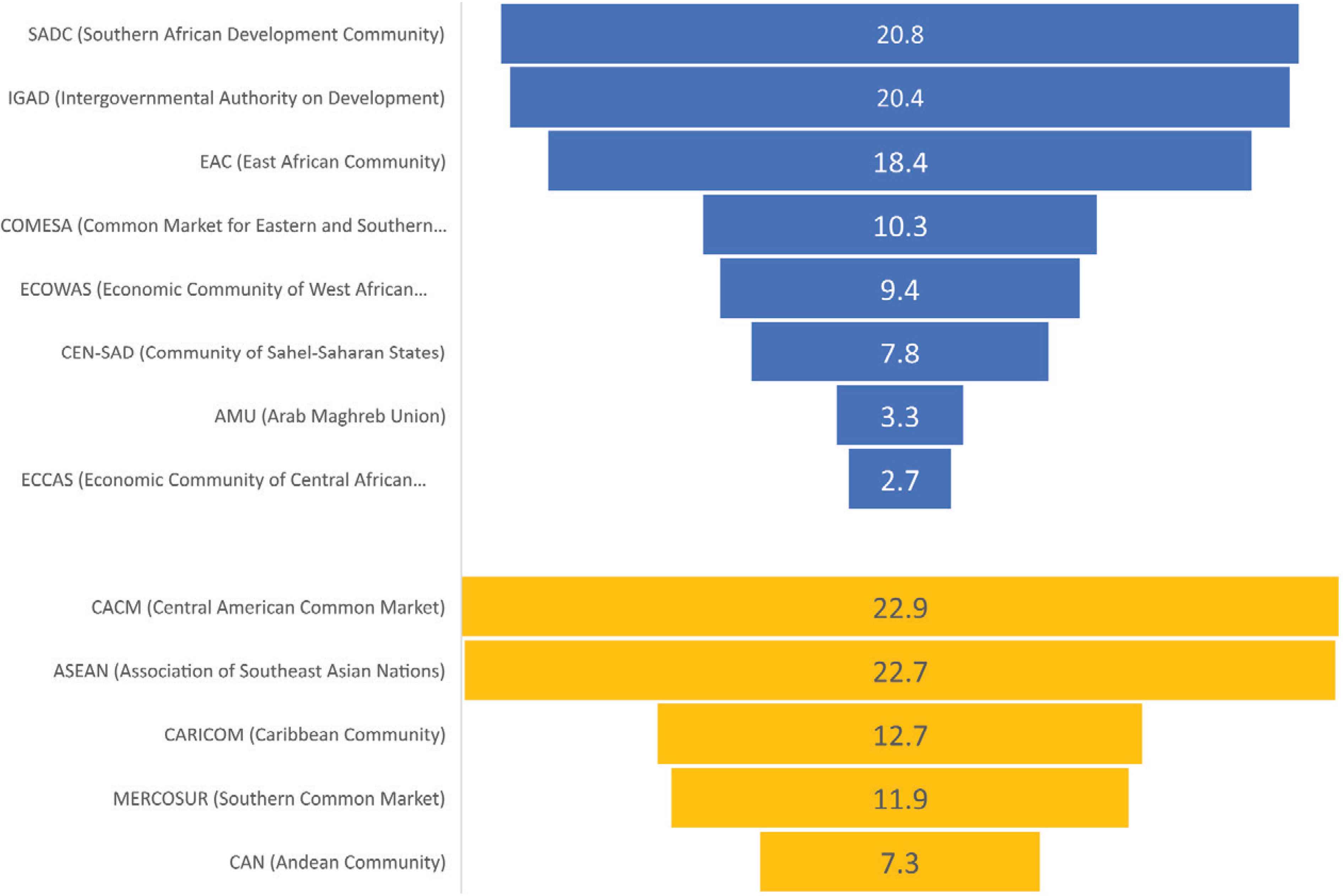

Firstly, although the comparison is commonplace, it is misleading to compare the level of intra-regional trade for African RECs with the European Union or indeed with the Asian economies.16 Unlike the African continent, both these regions are also usually considered as ‘resource poor’ (i.e., net importers of commodities) and the extensive hub-like nature of their respective production networks—in the words of Baldwin and Lopez-Gonzalez (2015), Factory Europe and Factory Asia—has driven intra-regional trade. Given also their much higher levels of industrialization and income per capita, such comparisons are thus not pertinent. More reasonable comparisons with MERCOSUR, CARICOM or ASEAN show the trade performance of African RECs in a much more favourable light (Figure 2).17

Intra-regional trade as a percentage of total trade, average 2016–2020. Source: UNCTADStat (2021).

Secondly, while econometric evidence tends to confirm that Africa is ‘under-trading’, once model specifications control for structural factors such as the lower level of industrialization or infrastructure, African countries are trading at about the expected levels (e.g., Bouet et al., 2008).18 Indeed, such research has the implication that overcoming the chronic infrastructure deficits within the framework of the AfCFTA could pay enormous dividends. Empirical evidence shows that improving trade logistics, such as customs services, and addressing poor infrastructure could be up to four times more effective in boosting African trade than tariff reductions (IMF, 2019; UNCTAD, 2019). Preliminary estimates show that the transitional phase of the AfCFTA alone could generate welfare gains of US$16.1 billion and significantly boost intra-African trade (UNCTAD, 2019).

Yet realizing these gains is not automatically guaranteed. Success hinges on the capacity of countries and governments to adopt and sustainably implement a wide range of complementary policies addressing multiple challenges to enhance the emerging nexus between trade, industrialization and services. These include reducing non-tariff barriers, removing the limitations to the development of productive capacities and providing the necessary trade-enabling infrastructure, trade finance and information, and improvements in factor market integration (IMF, 2019).

In the short term, these challenges are magnified by political wrangling around the AfCFTA. This is illustrated most notably by member countries’ difficulties in collectively settling on homogeneous rules of origin, even though the originating status clause is the centrepiece of the trade agreement and will critically determine the scope of its gains and shape the future of African RVCs (UNCTAD, 2019).19 While some countries are arguing for stringent rules of origin to ensure that preference accrues only to members and is not deflected to non-members, others—generally the least developed countries with weaker productive capacities—advocate more flexible, pro-developmental rules that allow them to source inputs from the cheapest and most competitive locations.

Even before the negotiations were carried out within the context of the AfCFTA, the debate about the stringency of the rules of origin was already raging within the region. One case study that has received much attention relates to challenges faced by Tanzanian exporters of textiles and apparel to the SADC region. Despite Tanzania’s privileged access to the highly prized South African market, the ‘double transformation’ rules of origin in the SADC region for textile and apparel products—which require local sourcing of input to qualify for duty-free trade—have resulted in negligible new investment in Tanzania (Boys and Andreoni, 2020). The merits of flexible versus stringent rules of origin have long dominated the process of economic integration and are discussed further in this issue from different (but converging) perspectives by Signé and Madden, as well as by Tsowou and Davis.

A growing number of countries are designing and implementing new policies to improve domestic production capabilities in manufacturing. For instance, in Zambia, the national strategy for the implementation of the AfCFTA recognizes the micro-, small- and medium-sized enterprises as the key drivers of growth and export diversification and is facilitating their integration into the continental market, by strengthening their capacity to participate in RVCs and GVCs. At the same time, the government of Zambia is revitalizing several national strategies (including the National Export Strategy, the National Industrial Policy and the National Local Content Strategy) to boost industrial output during the implementation of the AfCFTA.20 Others are supporting policies either to upgrade technology and industry or to retool existing policy frameworks in the mould of Asia’s export-led growth models (World Bank, 2005; Rodrik, 2006, 2018; Chang, 2007, 2021; Andreoni and Chang, 2019). In both cases, the objective is to mitigate the short-term costs associated with the AfCFTA’s implementation while also improving the business environment to maximize opportunities for value addition and boost intra-regional exports.

But just as trade policy cannot be a substitute for bold industrial policies, industrial policies must reflect the ongoing shift toward a continental approach to trade promotion. Regional trade regimes are clearly associated with the increasing intensity of RVCs and lead to more intra-regional trade (Begg et al., 2003; Kowalski et al., 2015). As regional production networks become an increasingly important feature of industrial development, industrialization will require more regional collaboration between AfCFTA member countries, including in the form of resource sharing.

ASEAN’s journey toward deeper economic integration through a common industrial policy, called the Industrial Cooperation Scheme, is instructive. The scheme proffered the framework for resource pooling and market sharing to facilitate the effective exploitation of economies of scale and locational advantage (Lowitt, 2011) and was instrumental in the success the region enjoyed, especially in the electronics and automotive industries (UNCTAD, 2019; WEF, 2021). The development of sub-regional economic zones, such as the SIJORI Growth Triangle (comprising Indonesia, Malaysia and Singapore), attracted substantial private investment in infrastructure. The AfCFTA’s success thus rests on a sustained commitment to and genuine investment in the long-term goal of regional integration by member states.

Afreximbank’s African Collaborative Transit Guarantee Scheme (Oramah, 2021)21 is one measure that will greatly help mitigate transport frictions that impede and add expenses to trade on the continent. But a comprehensive and holistic approach to non-tariff barriers is necessary, especially when one considers that Africa has a great many landlocked countries and that regional economies bear markedly high transport costs.22 In this regard, an effective implementation of BIAT, which aims to address the constraints to African trade under various trade policy clusters (trade facilitation, productive capacity, trade-enabling infrastructure, trade finance and trade information, and factor market integration), will be critical to ongoing efforts to establish vibrant RVCs and to deepen integration at the corporate level.

One major constraint that is emblematic of African trade concerns financing. The region has long contended with large and persistent trade financing gaps, which have been exacerbated by excessive reliance on foreign currencies (Afreximbank, 2020; Oramah, 2021) and the large-scale withdrawal of international banks and financial institutions from correspondent banking relationships as part of their de-risking programs to avoid stringent compliance and regulatory requirements (Erbenova et al., 2016; Fofack, 2017).

Although it has been proven to be a low-risk asset class, trade finance’s short-term and transactional nature has emerged as an important risk multiplier, with business cycle ‘credit crunches’ adversely affecting imports and exports. The Pan-African Payment and Settlement System provides a comprehensive digital framework for reducing the foreign currency content of intra-African trade, though its successful implementation depends on strengthening regional cooperation between central banks and monetary authorities (Oramah, 2021).

Effectively implementing the AfCFTA may involve some short-term adjustment costs, both private adjustment costs through labour and capital markets and public sector adjustment costs through fiscal channels (Saygili et al., 2018; IMF, 2019). Although empirical analysis from fiscal revenue and trade data suggests that, on average, fiscal revenue losses due to the AfCFTA are likely to be limited—owing to relatively low levels of intra-regional trade currently—losses in some countries could be larger, exceeding 1–2% of GDP (Songwe et al., 2021; Lunenborg and Roberts, 2021).23 Mitigating these costs, especially the fiscal adjustment costs that have implications for macroeconomic management, is particularly important to broaden support and strengthen the collective commitment toward the continental trade integration reform. In this regard, Afreximbank’s AfCFTA Adjustment Facility is proving to be especially timely (Oramah, 2021).

While some adjustment costs are temporary, others may persist and even increase over time. For instance, if an aggressive low-cost strategy by large firms leads to social downgrading, the trade gains from deepening regional integration will not be equitably distributed (Rodrik, 2018). Addressing this risk by maximizing the distributive effects of welfare gains associated with the AfCFTA calls for bold and regionally coordinated policy responses at different levels: firm and sectoral codes of conduct, national governmental regulations and policies, and the harmonization of rules and regulations produced by RECs and multilateral institutions. UNECA and the International Labor Organization have highlighted the importance of human rights and possible social-safety-net implications of the AfCFTA (Songwe et al., 2021).

Accelerating the expansion of manufacturing capacities and competitiveness of regional firms triggered by the AfCFTA will likely enhance Africa’s integration into the global economy and raise its share of global trade as the region strengthens its bargaining power. However, reaping the full benefits of the continental trade integration reform requires strengthening regional coordination and, above all, a genuine time-agnostic commitment by member states to the goal of regional integration—a difficult process that will invariably involve setbacks, as argued by Mold (2021). While not always politically expedient, especially in a region where countries are at different stages of economic development, national governments would be prudent to put the long-term goal of regional integration above short-term domestic considerations.

Prioritizing the collective interest is perhaps the most important challenge on the long road to integration in Africa, as has been so well illustrated by the rush to bilateral trade deals as well as inconsistency and uncoordinated engagement with the European Union within the context of economic partnership agreement negotiations in the absence of countervailing forces to resist external pressures (McDonald et al., 2014).24 Although the AfCFTA does not prevent member countries from entering a bilateral trade negotiation with third-party nations, doing so could affect regional trade patterns (e.g., through rules of origin requirements) and set precedents for regional trade and investment rules. In practice, bilateral deals with third parties could lead to trade deflection, given that the AfCFTA’s most-favoured-nation clause automatically extends tariff concessions granted to a third party to AfCFTA members.

For the AfCFTA to effectively become the launch pad for Africa’s deeper integration into the world economy as a proactive force of change and global income convergence, it will be critical to strengthen regional coordination mechanisms by engaging external partners as one single trading bloc. This especially must involve the large trading partners whose economic and trade interests are better served under bilateral trade deals than under multilateral ones. Credibly enforcing the rules of origin and strengthening instruments for regulating competition and facilitating dispute settlement will build market confidence and position the AfCFTA as a global-scale game changer. But no rule is as powerful as member states’ genuine commitment to and sustained investment in a shared vision of a brighter future where regional blocs dominate the globalized economic and financial system.

4. OVERVIEW OF THIS SPECIAL ISSUE

Beyond all the points raised above, the AfCFTA also represents an opportunity to deepen economic research for evidence-based policymaking on matters related to trade and regional integration. The contributions to this Special Issue represent the first attempt to address some of these research and policy questions, and in the process contribute to ongoing efforts to build a body of knowledge to support African governments and policymakers. It presents an appropriate mix of theoretical, policy-oriented and empirical work at the vanguard of examinations into regional integration and African trade.

Songwe et al. (‘The African Continental Free Trade Area: A Historical Moment for Development in Africa’) review the AfCFTA’s potential as a framework for setting Africa on the path toward structural transformation and sustainable development. After evaluating the role, the framework will play in fostering the economic recovery from the pandemic; the authors quantify the AfCFTA’s trade-related impacts and assess its contribution beyond trade. They also highlight UNECA’s ongoing backing for implementation, building on the support the Economic Commission for Africa has historically provided to regional and continental integration in Africa.

Oramah Benedict (‘Afreximbank in the Era of the AfCFTA’) argues that mobilizing financial resources early on to confront the region’s huge trade and infrastructure financing gaps will be critical for the AfCFTA’s implementation. The author outlines a wide range of initiatives and financing facilities (including the AfCFTA Adjustment Facility, Pan-African Payment and Settlement System, Trade Facilitation Program, the African Collaborative Transit Guarantee Scheme, and Intra-African Trade Fair) deployed by Afreximbank to fast-track the AfCFTA’s adoption.

In perhaps one of the first papers written on the link between the AfCFTA and environmental sustainability, Bengoa, Mathur, Narayanan and Norberg (‘Environmental Effects of the AfCFTA: A Computable General Equilibrium Approach’) use a CGE model and a novel dataset built from the GTAP database to estimate the effect of the AfCFTA on CO2 emissions, non-CO2 greenhouse gases and other pollutants. While they find that the AfCFTA’s implementation will lead to a marginal increase in CO2 emissions of 0.3% for Africa, they also find a major decline in air pollutants by 21.5%. Complicating matters further, AfCFTA implementation leads to an increase of 19.6% in non-CO2 greenhouse gas emissions. While the effects are mixed, the authors recommend the adoption of climate change mitigation measures during the AfCFTA’s implementation.

de Melo and Twum (‘Prospects and Challenges for Supply Chain Trade Under the AfCFTA’) evaluate the participation of African RECs in GVCs over the period 1990–2015, using measures of backward and forward GVC participation. The authors find that, despite a modest increase in their participation, African RECs still lag comparator groups, largely because they participate in GVCs along forward rather than through backward activities, i.e., still as providers of raw materials.

Fofack et al. (‘Estimating the Effect of AfCFTA on Intra-African Trade Using Augmented GEPPML’) employ a GEPPML model, augmented by dynamic capital accumulation, to provide ex ante estimates of the AfCFTA’s impact on intra-African trade flows. Among other conclusions, the authors find that the AfCFTA would increase intra-African trade by around 24% compared to the baseline, in a static setting, and by more in the long run when dynamic capital accumulation is introduced into the model.

Signé and Madden (‘Considerations for Rules of Origin Under the AfCFTA’) analyse preference margins, the availability of intermediate inputs, trade volumes and potential certification costs in Africa. They find that while preference margins are high for many products, the availability of intermediate inputs and trade volumes are generally low, and certification may be difficult for Africa’s large numbers of small- and medium-sized enterprises. They advocate the progressive harmonization of RECs’ rules of origin, with the goal of gradually reducing the number of product-specific rules and moving toward the overarching application of general, co-equal rules.

After highlighting the growth-constraining aspects of heterogeneous rules of origin across RECs and costly trade facilitation procedures, Tsowou and Davis (‘Reaping the AfCFTA Potential Through Well-Functioning Rules of Origin’) argue for the adoption of pro-developmental rules of origin to enable production hubs to reap the benefits of integrated markets. They articulate the contours of such rules, stressing that they must be sufficiently flexible to allow the maximum amount of intra-African trade under the AfCFTA.

Lunenborg and Roberts (‘ECOWAS and AfCFTA: Potential Short-Run Impact of a Draft ECOWAS Tariff Offer’) provide an ex ante short-run impact analysis of AfCFTA liberalization on tariff revenues for the Economic Community of West African States (ECOWAS). The authors find that tariff revenue losses for a scenario with 97% tariff liberalization amount to around US$262 million at the end of the implementation period, representing 12.5% of total tariff revenues. This is larger than previously anticipated, mainly because ECOWAS negotiates as a bloc and its selection of sensitive sectors exempted from liberalization is not ‘optimized’ at the country level to minimize revenue losses.

Mold (‘Proving Hegel Wrong: Learning the Right Lessons From European integration for the African Continental Free Trade Area’) takes an historical perspective, by highlighting the lessons that can be gleaned from the European Union’s Single Market Programme (SMP) of 1993 to inform the AfCFTA’s implementation. This is done by an extensive review of the empirical literature into the trade, investment and distributional impacts of the SMP. Although the parallels are not like-for-like—structurally, in the level of development and resources available—the author highlights nine major lessons, including the scale of benefits to be expected, the role of multinational corporations, the need for an effective competition policy and the importance of public buy-in to the regional integration process.

CONFLICTS OF INTEREST

The authors declare they have no conflicts of interest.

AUTHORS’ CONTRIBUTION

HF and AM both contributed to conceptualizing and writing the manuscript. Comments on the original and revised drafts were addressed by both HF and AM.

ACKNOWLEDGMENT

The authors would like to thank Augustin Fosu for his invaluable comments on an earlier version of this paper and the anonymous reviewers.

Footnotes

See, inter alia, Afreximbank (2018), Saygili et al. (2018), UNCTAD (2019), IMF (2019), World Bank (2020a) and ECA and TMEA (2020). Forty-four African countries signed the landmark AfCFTA agreement during the Extraordinary Session of the African Union Heads of State, hosted by the government of Rwanda in Kigali on 21 March 2018. Since then, 54 of 55 African Union member states have signed up to the agreement and more than 40 countries have ratified the agreement at the time of writing.

Total African trade accounted for more than 4% of global trade in the period immediately following the end of the colonial era. Its decline partly reflects the changing patterns of global trade, which manufactured goods increasingly dominate, and the stickiness of the colonial development model of resource extraction (Fofack, 2019).

Trade data from UNCTADStat.

Informal trade is estimated to account for 30–40% of intra-African trade (Brenton and Soprano, 2018; Afreximbank, 2020).

Encouragingly, the share of the workforce employed in manufacturing in sub-Saharan Africa has also risen from 7.2% of the total in 2010 to 8.4% in 2019 (Kruse et al., 2021).

Recent developments in a growing number of sectors point to the increasingly diverse composition of intra-African exports, especially in the automotive, apparel and retail industries (Pasquali et al., 2021; WEF, 2021). Across East Africa, RVC-oriented firms are fulfilling a wide range of functions, including vertical integration and textile manufacture as well as higher-value-added activities (Boys and Andreoni, 2020). Intra-African automotive exports accounted for around 16% of Africa’s total automotive exports in 2019 (WEF, 2021). With its cumulative provisions in interregional rules-of-origin regimes, the AfCFTA will greatly amplify RVCs and their contributions as drivers of economic integration and industrialization (UNCTAD, 2019).

“Affluent” consumers are expected to spend an additional $200 billion per year from now until 2025, with approximately one in five Africans spending more than 70% of their income on discretionary items, signaling growing demand for electronics, appliances and labor-intensive goods like clothing and footwear (Signé, 2020, citing McKinsey & Company Report, 2016).

BIAT was established to address the main challenges on the path to regional and continental integration in Africa, with the specific aim of unlocking the benefits of trade for sustainable growth and economic development.

For more details, see https://www.volkswagen-newsroom.com/en/press-releases/first-for-africa-volkswagen-and-siemens-launch-joint-electric-mobility-pilot-project-in-rwanda-5510.

Although FDI inflows to the region have remained very low, a growing number of empirical studies also attribute the limited FDI spillovers in Africa to its extremely large concentration in the primary and services sector (Narula and Driffield, 2012).

https://www.brookings.edu/research/the-ruinous-price-for-africa-of-pernicious-perception-premiums/ (see Fofack, 2021).

The Abuja Treaty advocated the creation of the continent-wide African Economic Community by 2027, which the REC arrangements underpinned (UNCTAD, 2009).

The six steps included (i) strengthening existing African RECs and establishing new RECs within a period not exceeding 34 years from 1991; (ii) ensuring consolidation within each REC and harmonization between the RECs by 2007; (iii) establishing free trade areas and customs unions in each REC by 2017; (iv) coordinating and harmonizing tariffs and non-tariff systems among RECs with a common vision of creating a continental customs union; (v) creating an African custom market by 2019; and (vi) establishing an African Economic Community that includes an African monetary union and a Pan-African Parliament.

Besides its economic and development potential, integration was seen as crucial to transcending the colonial boundaries erected after the 1884–85 Berlin Conference and to strengthen the continent’s voice in the international arena. This view was championed especially by Kwame Nkrumah, the founding president of Ghana, in his 1963 book Africa Must Unite.

The three most pertinent articles of the agreement in this regard are Articles 5, 8 and 19. For a discussion, see Erasmus (2021).

In fact, at 9.0% and 6.7% of total trade, respectively, Southern and Central Asia have extraordinarily low levels of intra-regional trade—much lower than on the African continent (17%) (based on the average for 2016–20 from the UNCTADStat database). The high share of intra-Asian trade is accountable by the intensive production networks of South-East and Eastern Asia, plus the fact that the Asian continent accounts for nearly 60% of the global population.

Moreover, Nicita and Saygili (2021) find that trade within trade agreements was relatively more resilient against the global trade collapse of 2020. The analysis also finds that the level of integration matters. Deep regional trade agreements have provided relatively better stability against the global shock.

It is interesting to note that similar results were found in a firm-level analysis of manufacturing firm productivity across 80 countries by Harrison et al. (2014). Without controls, manufacturing African firms perform significantly worse than firms in other regions. But once geography, political competition and the business environment were controlled for, formal African firms lead in productivity levels and growth. The key factors explaining Africa’s disadvantage at the firm level were the lack of infrastructure, access to finance and political competition, with the implication that by addressing those constraints, African firms are perfectly able to compete on regional and global markets.

Negotiations on the rules of origin, which should have been finalized by the end of June 2021, have been delayed for several reasons, including the diverse rules of origins used in Africa’s main RECs and the underlying differences in perspectives on the subject (Signé and Madden, 2021).

See Oramah (2021).

Freund and Rocha (2011) examine the effects of transit, documentation and ports and customs delays on exports from Africa and find that transit delays have the most economically and statistically significant effect on exports.

In this issue, estimates of fiscal adjustment costs are derived for the whole continent (Songwe et al., 2021) and for ECOWAS (Lunenborg and Roberts, 2021).

Historically, African governments have entered into agreements with the European Union with little or no coordination with the rest of the membership, leaving countless issues unresolved between them and exposing internal contradictions. For more details, see McDonald et al. (2014).

REFERENCES

Cite this article

TY - JOUR AU - Hippolyte Fofack AU - Andrew Mold PY - 2021 DA - 2021/12/15 TI - The AfCFTA and African Trade—An Introduction to the Special Issue JO - Journal of African Trade SP - 1 EP - 11 VL - 8 IS - 2 (Special Issue) SN - 2214-8523 UR - https://doi.org/10.2991/jat.k.211206.001 DO - 10.2991/jat.k.211206.001 ID - Fofack2021 ER -