Considerations for Rules of Origin under the African Continental Free Trade Area

- DOI

- 10.2991/jat.k.201205.001How to use a DOI?

- Keywords

- Rules of origin; African continental free trade agreement; preferential trade agreements; intra-African trade

- Abstract

Rules of origin are used to determine a product’s eligibility for preferential tariffs under a free trade agreement and have major implications for the extent of trade under the agreement and the growth of regional value chains. Firms choose to comply with rules of origin when the benefits of trading under an agreement, determined primarily by the preference margin, are higher than the costs of complying with rules of origin, determined by the costs of sourcing products from within the free trade area and from the costs of certifying that products comply with rules of origin. In addition, as there is a fixed cost component of complying with rules of origin, compliance is more likely when trade volumes are large. Negotiations for rules of origin under the African Continental Free Trade Area (AfCFTA) are complicated by the diverse rules of origins used in Africa’s many regional economic communities. We analyze preference margins, the availability of intermediate inputs, trade volumes, and potential certification costs in Africa. We find that although preference margins are high for many products, the availability of intermediate inputs and trade volumes are generally low, and certification may be difficult for Africa’s large numbers of small and mid-size enterprises. We then argue that the AfCFTA should pursue progressive harmonization of regional economic communities’ rules of origin across the continent, with the goal of gradually reducing the number of product-specific rules and moving towards the overarching application of general, co-equal rules. In addition, the costs of certification must be minimized in order to increase exporter participation.

- Copyright

- © 2020 African Export-Import Bank. Publishing services by Atlantis Press International B.V.

- Open Access

- This is an open access article distributed under the CC BY-NC 4.0 license (http://creativecommons.org/licenses/by-nc/4.0/).

1. INTRODUCTION

The African Continental Free Trade Area (AfCFTA) holds great potential for African growth and development. Maliszewska and Ruta (2020) estimate that real income gains from full implementation of the AfCFTA could total nearly $450 billion, and that the AfCFTA could lift an additional 30 million people from extreme poverty and 68 million people from moderate poverty by 2035. The United Nations Economic Commission for Africa (UNECA, 2018) estimates that a fully implemented AfCFTA will increase intra-African trade by 15–25%, or $50–70 billion, by 2040. Furthermore, Signé (2018) estimates that under a successfully implemented AfCFTA, Africa will have a combined consumer and business spending of $6.7 trillion in 2030. However, these estimates are all contingent on ambitious trade liberalization across the continent. Trade liberalization does not just refer to the schedule of tariff reductions; a major component of liberalization are rules of origin (ROO)—the rules that define whether a product qualifies for preferential tariffs under the AfCFTA. Negotiations for rules of origin under the AfCFTA should play a substantial role in determining the extent of trade that occurs under the agreement, and thus the benefits accrued to African countries and firms.

To better understand the impact of rules of origin, we analyze potential determinants of compliance under the AfCFTA. We first quantify potential benefits from preference margins—the difference between Most Favored Nation (MFN) tariffs and preferential tariffs—which are the primary determinant of profits for exporting firms from trading under the AfCFTA. Manchin and Pelkmans-Balaoing (2007) find that global liberalization in trade has led to lower MFN tariffs, resulting in increasingly insubstantial preference margins. In contrast, we find that preference margins in Africa are generally high, particularly outside of natural resources. Nicita (2011) similarly finds high preference margins for low-income developing countries, including Lesotho, Madagascar, Malawi, Mauritius, and Zimbabwe. UNCTAD (2019) analyzes the preference margins of 20 products traded within Africa, and finds the highest preference margins for beverages, tobacco products, some meats, and clothing.

We then study potential costs, including the costs of sourcing inputs either domestically or from within AfCFTA member countries in order to comply with rules of origin, and the costs of certifying compliance. We analyze intra-African food and beverage value chains and then expand on the methodology of Foster-McGregor et al. (2015) to examine intra-African trade in intermediate goods, and find that, although trade in intermediate goods is generally low, there exists some capacity for trade in intermediate inputs for simple manufacturing processes. Our analysis builds upon that of UNCTAD (2019), who analyze regional value chains for the tea, cocoa–chocolate, cotton–apparel, beverage, cement, and automotive sectors, and find that the potential impact of rules of origin is highly context specific.

Regarding certification, we argue that self-certification, as opposed to certification by a public or private official, is generally less costly (Manchin and Pelkmans-Balaoing, 2007; Estevadeordal and Suominen, 2006; UNCTAD, 2019). Muluvi et al. (2012) find that within the East African Community (EAC), which does not provide for self-certification, the procedure for obtaining a certificate is generally difficult and expensive for firms. Similarly, Medalla and Balboa (2009) find that in the Association of Southeast Asian Nations (ASEAN) Free Trade Area (AFTA), compliance with government certification processes is costly and administratively burdensome.

Finally, we analyze intra-African trade volumes, focusing on the case of Ghana, in order to examine whether sufficient incentives exist for African exporters to incur the fixed and variable costs of compliance with potential AfCFTA rules of origin. Conconi et al. (2018) suggest that tariff preferences might not be used unless export volumes are sufficiently large to result in substantial savings from preferential tariffs. Similarly, the World Bank and Organisation for Economic Co-operation and Development (OECD, 2016) find that the fixed costs of rules of origin compliance can disproportionately affect smaller firms with lower trade volumes. As in the work of UNECA (2018) and Songwe (2019), who analyze Africa’s regional trade and participation in value chains and find generally low rates of intra-African trade, we find that intra-African trade volumes are relatively low, and that there is a preponderance of trade at low values.

Overall, we find that both the potential benefits and costs of complying with the AfCFTA’s rules of origin are high. Assuming a low or zero preferential tariff under the AfCFTA, preference margins are relatively high across most countries and most products, with the exception of most natural resource such as chemicals, fuels, and minerals. However, intra-African value chains are not well developed, and it is likely to be difficult and costly for African exporters to source many intermediate goods from domestic or regional sources in order to comply with rules of origin. In addition, we find that intra-African trade volumes are relatively low, suggesting that the fixed cost components of rules of origin may be burdensome for many African traders, particularly Small and Mid-size Enterprises (SMEs) and those located in Least Developed Countries (LDCs). As a result of these constraints, we suggest that the AfCFTA progressively work toward the adoption of simple, harmonized rules of origin, by gradually phasing out the product-specific rules adopted as a result of the inconsistent regulations of Regional Economic Communities (RECs).

The paper proceeds as follows. Section 2 provides an overview of rules of origin and discusses the strengths and drawbacks of the criteria used to determine compliance. Section 3 contextualizes rules of origin within the case of the AfCFTA, discusses the status of negotiations, and provides considerations unique to the AfCFTA. Section 4 analyzes the determinants of compliance with rules of origin, including preference margins, the cost and availability of qualifying intermediate inputs, certification processes, and trade volumes. Section 5 argues that, given the findings in Section 4, rules of origin must be simple and should be gradually harmonized to encourage compliance. It further discusses issues relating to RECs. Section 6 concludes.

2. RULES OF ORIGIN: AN OVERVIEW

The fragmentation of production processes under Global Value Chains (GVCs) makes it difficult to define the origin of a good, as the process of assembling and delivering a product to its final consumer can involve a wide range of activities, including manufacturing, assembly, packaging, and transport, all of which may involve intermediate goods imported from different countries (Conconi et al., 2018). Rules of origin are used to define where a product was made, and thus whether or not it is eligible for preferential tariffs under a free trade agreement. By defining eligibility for participation in a preferential trade agreement, rules of origin prevent trade deflection, which may occur if products from nonparticipating countries are reexported at profit into a free trade area through participating countries with lower MFN rates than the destination country. Rules of origin also provide incentives for industries to source intermediate inputs from within the free trade area in order to qualify for preferential tariffs, potentially spurring the development of regional value chains.

To qualify as originating, products may either be wholly obtained or substantially transformed within a member country. Wholly obtained products—generally primary commodities—are those which have been entirely grown, harvested, or extracted from the territory of a member country, or have been manufactured exclusively from those products (UNCTAD, 2019). Substantial transformation requires sufficient working or processing of externally sourced inputs, and is determined on the basis of three criteria: a Change in Tariff Classification (CTC), a minimum (or maximum) value added of internally sourced inputs as a percentage of the final product’s value, or specific production processes. Most preferential trade agreements use a combination of all three rules. Some agreements also apply “hybrid tests,” which require the satisfaction of two or more criteria in order to confer origination: for example, a hybrid test could require that a product complies with both a minimum value-added threshold and a CTC to qualify as substantially transformed. Another, more liberal approach is “alternative” or coequal rules, which allow firms to choose a rule among two or more rules in determining origin (Medalla and Balboa, 2009).

Each of the criteria used to determine substantial transformation has strengths and weaknesses. Although CTC provides unambiguous conditions for determining origin and may be administratively easy to apply, the Harmonized System of tariff classifications was not designed for use in rules of origin, and transformation requirements vary in restrictiveness and difficulty by product type. Value-added rules can be applied across a wide range of products and are conceptually easy to understand, but calculating value added can be extremely complex, particularly for SMEs without robust accounting procedures. Specific production processes provide, as with CTC, unambiguous conditions for conferring origination, but can quickly become obsolete as technological processes change (Brenton, 2011).

Rules of origin additionally include regime-wide rules that apply to all products, which include cumulation, tolerance/de minimis, absorption/roll-up, and certification and transportation requirements, among others. Cumulation allows imported inputs to qualify as originating if sourced from another member of the free trade agreement or other agreed-upon countries. Tolerance allows for a set percentage of nonoriginating inputs to be used in production without affecting origin. Absorption allows materials that have obtained origin by undergoing specific processing requirements to be considered as fully originating when used as input in a subsequent transformation (Medalla and Balboa, 2009). Application of these three rules can offset the restrictiveness of rules of origin, allowing for increased participation in the free trade area.

3. RULES OF ORIGIN AND THE AfCFTA

The AfCFTA ROO negotiations have major implications for the AfCFTA, as they will not only shape exporting firms’ choices of inputs, but also their ultimate decisions to participate in the free trade area. If rules of origin encourage firms to source local inputs without imposing prohibitive costs, the AfCFTA has the potential to stimulate local production and shape regional value chains, resulting in increased net trade between AfCFTA members and the diversification of production along supply chains with corresponding net income and welfare gains. However, if rules of origin are overly restrictive, requiring firms to use inputs that are costly or unavailable from domestic or regional sources and to comply with complex and expensive administrative procedures, they will severely limit trade under the AfCFTA and prevent the agreement from reaching its full potential.

Article 6 of Annex 2 of the Protocol on Trade in Goods sets out criteria for sufficiently worked or processed products. It provides for the use of coequal rules of origin, considering products that are not wholly obtained to be sufficiently worked or processed when they fulfill one of the following criteria: (1) value added, (2) nonoriginating material content, (3) change in tariff heading, or (4) specific processes. Article 6 also allows for product-specific rules, stating that notwithstanding the above provision of coequal rules, certain goods only qualify as originating if they satisfy specific rules set for their qualification. The allowance for product-specific rules comes, in part, because of the stipulation that the AfCFTA account for rules of origin in current RECs.

The heterogeneity of countries and RECs party to the AfCFTA complicates negotiations: larger and more advanced African economies, such as South Africa and Nigeria, have advocated for stricter, product-specific rules of origin out of concern that lenient rules will encourage trade deflection (Signé and van der Ven, 2019). In contrast, following the 2015 tenth World Trade Organization Ministerial Conference, the LDC Group noted that even simple, generally applied rules of origin might be difficult to meet given production capacities and the globalization of value chains (UNCTAD, 2019). Given the weak state of manufacturing in Africa and the dominance of SMEs in the private sector, the stricter the rules of origin the AfCFTA adopts, the more difficult it will be for firms to meet the value-added threshold and be able to receive the AfCFTA tariff preference (Signé and van der Ven, 2019). Furthermore, the coexistence of different RECs’ rules of origin that must be adhered to depending on the trade agreement used when engaging in intra-African trade will increase the complexity of intra-African trade, rather than to reduce it.

Experience from Africa’s preferential trade agreements with the United States (US) and the European Union (EU) shows that restrictive rules of origin significantly limit the benefits of such agreements. Restrictive, product-specific, and complex rules of origin in the EU’s Everything but Arms agreement resulted in low utilization rates of preferences and the expansion of exports under other preferential agreements with less restrictive rules (Brenton, 2006). In contrast, the more flexible rules of origin of the US African Growth and Opportunity Act—particularly those relating to apparel—have stimulated exports from African LDCs, whose exports of clothing to the United States increased 10-fold from 1996 to 2006 whereas those to the EU stagnated (UNCTAD, 2019; Brenton, 2006). Furthermore, recent research from Felbermayr et al. (2019) finds that trade deflection is not profitable for a large majority of all products traded within free trade areas because of similarities between countries’ external tariffs and high transportation costs. This finding suggests that the need for rules of origin to prevent trade deflection may be overstated.

However, there are benefits to stricter rules of origin outside of the prevention of trade deflection. If local production of intermediate inputs exists, stricter rules of origin incentivize the use of those products, and thus help to build regional value chains and generate value within the trade area. Overly liberal rules, in contrast, result in more foreign value added to products, more international (as opposed to regional) trade, and less regional industrialization. In this way, liberal rules may attract investment but prevent substantial value-added creation. In addition, in case studies of the garment sector in Lesotho, Kenya, Madagascar, Bangladesh, Sri Lanka, and Cambodia, van der Ven (2015) finds that although flexible rules of origin generate higher preference utilization rates, they do not always correlate with higher levels of domestic industrial development, but rather tend to create higher levels of vulnerability and dependency on export markets.

Given these considerations, we argue that the AfCFTA should pursue simple, harmonized rules of origin in order to spur regional value chain development and increased industrialization. The stipulation of coequal rules is a useful first step to decrease costs of compliance, particularly for SMEs and LDCs, and to improve participation while still enabling the prevention of trade deflection. However, rules of origin will also need to be gradually harmonized across RECs in order to reduce the costs of complying with excessive numbers of product-specific rules. In addition, certification processes must be simple and low-cost. Self-certification processes will provide the greatest benefits for SMEs and LDCs, and capacity-building programs must be established to improve knowledge of certification processes. Particular attention should be given to the rules of origin for sectors with substantial potential for trade under the AfCFTA, which includes sectors with high MFN tariff rates, capacity to source from within Africa, and high trade volume. As AfCFTA negotiators have already agreed on rules of cumulation, tolerance, and absorption (UNCTAD, 2019), we will not discuss these rules at length, focusing instead on considerations for the determination of substantial transformation and on certification processes.

4. DETERMINANTS OF COMPLIANCE WITH RULES OF ORIGIN

Rules of origin vary in restrictiveness. A high value-added requirement is more restrictive than a low value-added requirement; a change at the heading level of the Harmonized System of classification is more restrictive than a change at the subheading level; and double transformation, in which the fabric used to create apparel must be sourced from a qualifying origin for the apparel itself to qualify for originating status, is more restrictive than single transformation, in which fabric from any source may be used (UNCTAD, 2019). The restrictiveness of rules of origin determines whether exporters will utilize a free trade area by specifying the location from which inputs must be sourced, and thus placing a lower bound on the cost of those inputs. When the costs of complying with rules of origin are less than the benefits of utilizing trade preferences, exporters will comply and trade under the free trade agreement. Multiple studies have estimated the costs of compliance, and have generally found costs of about 5% of final product prices (Abreu, 2016; Brenton, 2011; Cadot and de Melo, 2008; Cadot et al., 2007; Portugal-Perez and Wilson, 2008).

Preference margins—the difference between the MFN tariff rate and the preferential tariff rate—primarily determine the benefits to a firm of complying with rules of origin. Conversely, the costs of rules of origin are determined by the costs of sourcing products from within the free trade area and from the costs of certifying that products comply. As there is a fixed cost component of complying with rules of origin—including establishing rigorous accounting procedures and searching for qualifying input suppliers—compliance is more likely when trade volumes are large. Below, we discuss these issues, in addition to special considerations applicable to value-added rules.

4.1. Preference Margins

Exporters profit from trading under a free trade area because of preference margins. François et al. (2006) find that exporters start to trade under preferential agreements when preference margins are about 4–4.5% (UNCTAD, 2019). In contrast, Haddad (2007) finds that preferences start to stimulate trade only when preferential rates are at least 25% points lower than MFN rates. The increasing liberalization of trade has led to lower MFN tariffs worldwide, and has thus eroded some of the benefits of preferential trade agreements, particularly if the costs of ROO compliance are high (Manchin and Pelkmans-Balaoing, 2007).

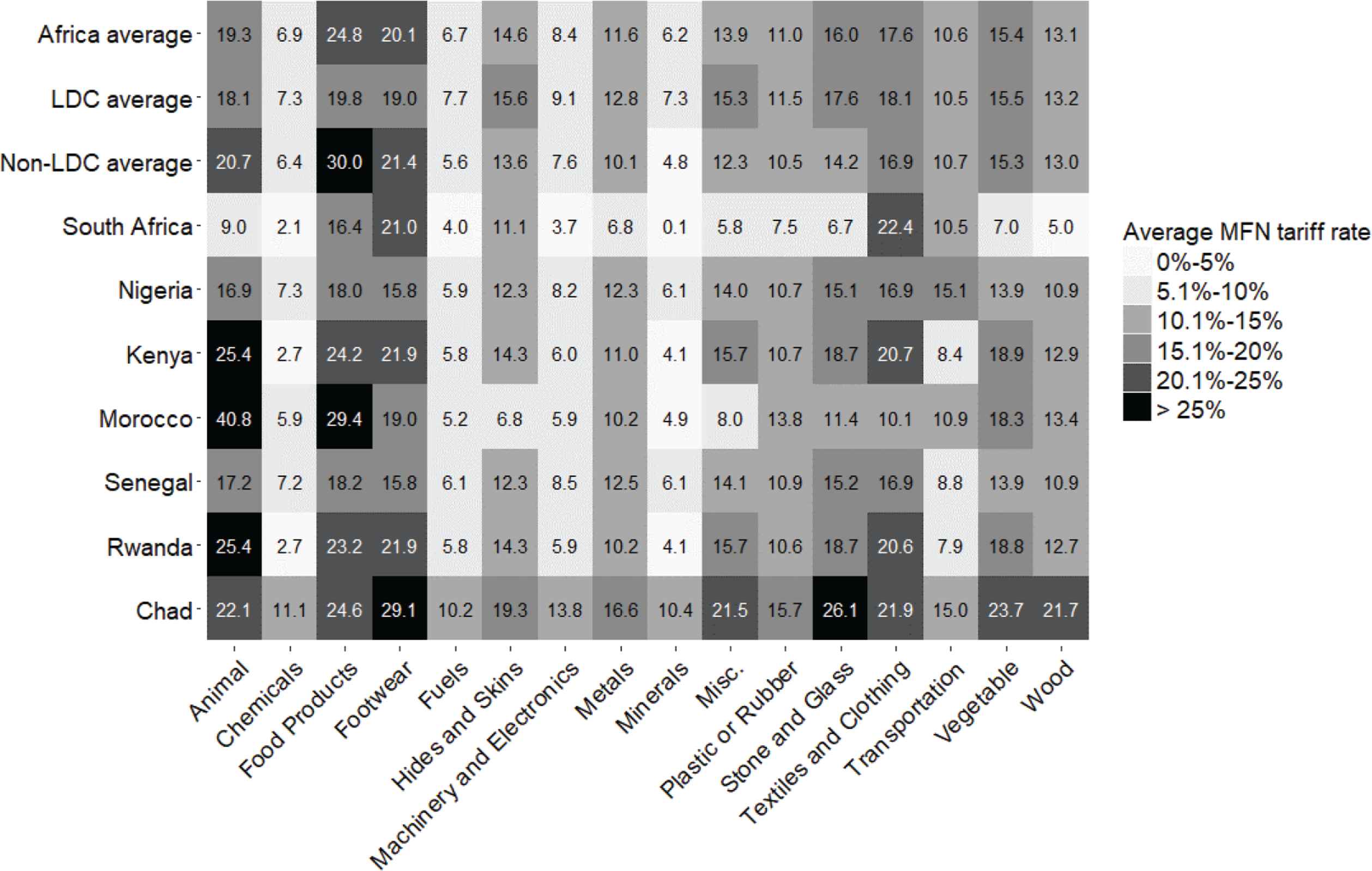

However, Figure 1 shows that in Africa, MFN tariff rates remain relatively high across some product groups.1 Across all products and all African countries,2 the average MFN tariff rate in Africa is 12.9%. There is significant heterogeneity by product: many natural resources have low MFN tariff rates, including chemicals, fuels, and minerals, at 6.9%, 6.7%, and 6.2%, respectively. In contrast, MFN tariff rates are relatively high for animal products, food products, footwear, and textiles and clothing, at 19.3%, 24.8%, 20.1%, and 17.6%, respectively. There is also heterogeneity by country and level of development: LDCs,3 on average, have somewhat higher MFN tariff rates than non-LDCs, at 13.1% and 12.6%, respectively. However, the data provided for select countries—South Africa, Nigeria, Kenya, Morocco, Senegal, Rwanda, and Chad—suggests that, although there are variations in MFN tariffs by country (with Chad, e.g., having particularly high MFN tariffs on most products, with an average rate of 18.1%, and South Africa having particularly low MFN tariff rates, with an average of 8.2%), the more significant determinant of the tariff rate is the type of product.

MFN tariff rates by product area. Source: Authors’ calculations from UNCTAD Trade Analysis Information System (TRAINS), 2020. Note: Averages are simple (unweighted) averages. Data are from 2018 or most recent available year. Eritrea is excluded as a non-signatory to the AfCFTA. Libya, Somalia, and South Sudan are excluded due to data availability issues. Similarities between Rwanda and Kenya are due to their common application of the East African Community Common External Tariff due to membership in the East African Community Customs Union.

This analysis of MFN tariff rates suggests that, with low (or zero) preferential tariff rates, preference margins could be substantial within the AfCFTA. Margins for most products in most countries are likely to exceed the 4–4.5% found by François et al. (2006) to stimulate preferential trade, although they are unlikely to exceed the 25% found by Haddad (2007). Taking these two values as lower and upper bounds for the stimulation of preferential trading under a free trade area, we argue that preference margins in Africa will be sufficient to incentivize exporters to comply with rules of origin and trade under the AfCFTA, particularly in high-MFN tariff product groups such as footwear, textiles, and clothing.

4.2. Availability and Cost of Inputs

Preference margins are, however, not the only consideration driving compliance with rules of origin. The ability to source inputs either domestically or from within the free trade area is also of critical importance. The restrictiveness of rules of origin depends on whether exporters have the capacity to source inputs either domestically or, if allowed, from other countries within the trade area. If exporters cannot import inputs from within the agreement area because of unavailability or high costs, they will instead source inputs from nonparticipating countries and export at MFN tariff rates (UNCTAD, 2020).

In general, African value chains are not well developed. Although intra-African trade increased from about 10% in 1995 to about 17% in 2017 (Songwe, 2019), faster progress is necessary to reach levels of intraregional trade comparable to those of Asia or Europe.4 Furthermore, participation in GVCs is extremely low, particularly for sub-Saharan African countries, and participation generally occurs at the beginning of GVCs through the export of commodities. Analysis by Allard et al. (2016) finds that the share of foreign value added in the production of exports—an indication of participation at more advanced stages of GVCs, and more broadly of the availability of intermediate inputs within the region—is relatively low, at 15% of exports compared to the average of 20% in developing and emerging market economies. In addition, Africa’s integration into GVCs has barely increased since the mid-1990s (Ibid).

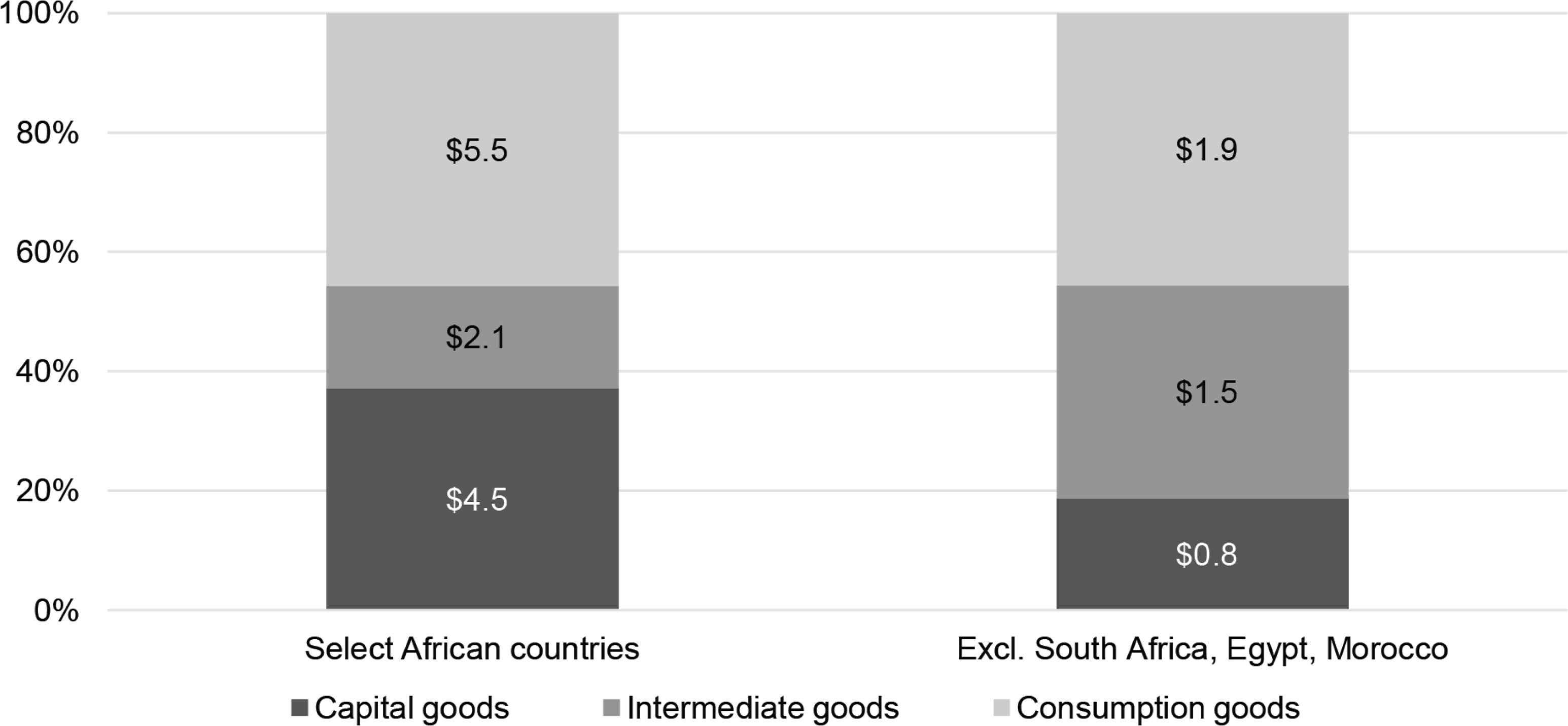

To further examine this constraint, we analyze the composition of exports in the food and beverage sector for 20 African countries5 for whom broad economic category data are available for 2019 from UN Comtrade (2020a and 2020b). We find that intra-African exports in the food and beverage sector are concentrated in consumption goods, at $5.5 billion of exports, equaling 46% of all food and beverage-related exports (Figure 2). Intermediate goods comprise the least value of intra-African food and beverage-related exports, at $2.1 billion, equaling 17% of related exports. This picture changes somewhat when South Africa, Egypt, and Morocco—large countries with relatively well developed and diversified industrial sectors—are excluded from calculations. Consumption goods still comprise 46% of intra-African food- and beverage-related exports, at a value of $1.9 billion, but the relative importance of intermediate goods rises to 36% of exports, and that of capital goods falls.

Intra-African food and beverage exports by good type, 2019. Source: Authors’ calculations from UN Comtrade (2020a and 2020b). African countries include Botswana, Comoros, Cote d’Ivoire, Egypt, eSwatini, Gambia, Ghana, Madagascar, Mauritius, Morocco, Namibia, Republic of Congo, Rwanda, Sao Tome and Principe, Senegal, Seychelles, South Africa, Togo, Zambia, Zimbabwe.

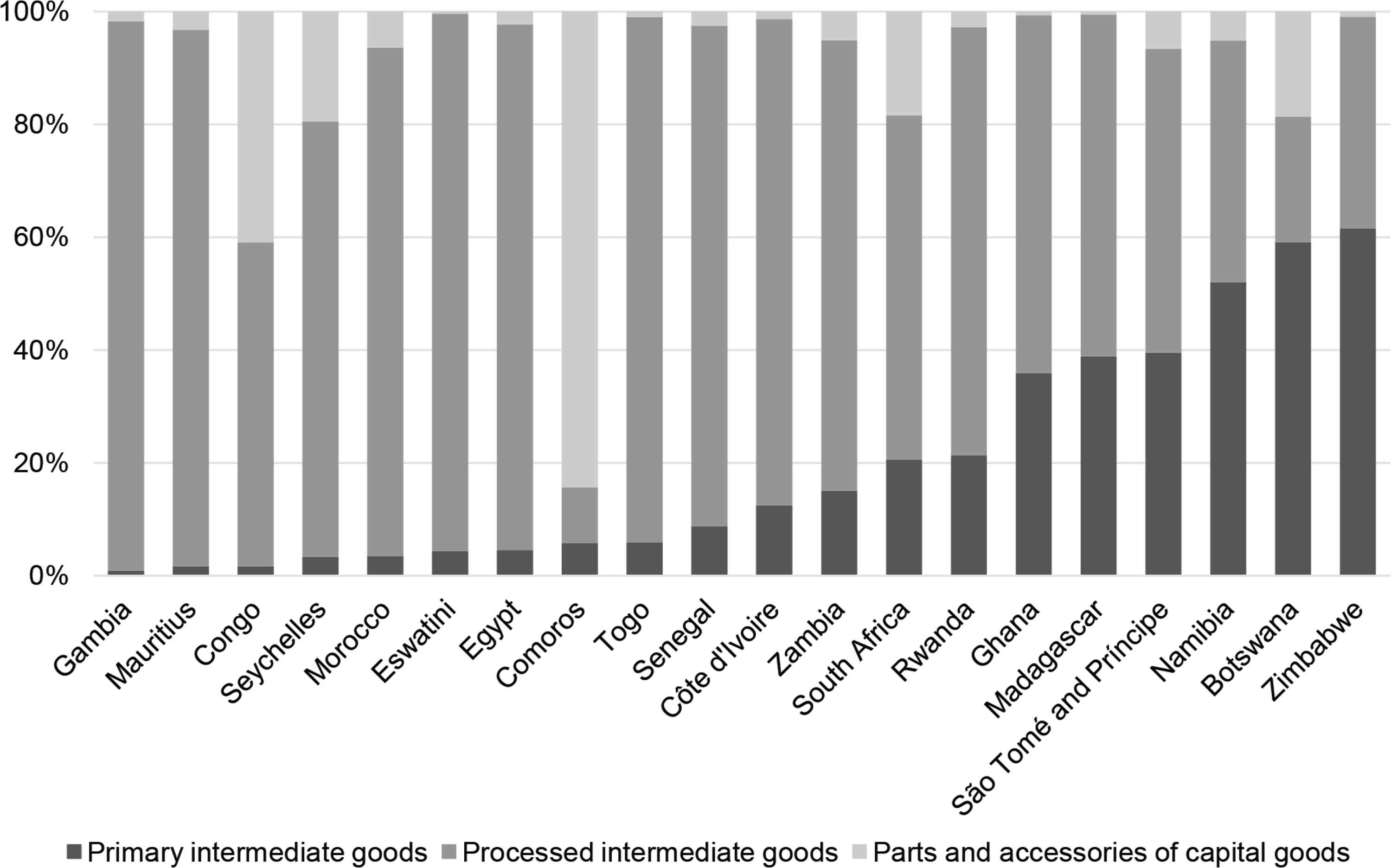

However, further analysis of intra-African trade in intermediate goods reveals that regional trade in intermediate inputs is predominated by processed inputs, rather than primary products (such as fuels, primary industrial supplies, and primary food and beverages). On average, 66% of intra-African trade in intermediate products for the sample of 20 countries listed above takes place in processed products, 24% in primary products, and 10% in parts and accessories of capital goods. Figure 3 breaks down this composition by country, and shows that only Zimbabwe, Botswana, and Namibia export more than 50% primary products as a total of their intermediate goods exports. In contrast, in an analysis of Africa’s participation in GVCs, Foster-McGregor et al. (2015) find that in 2010, in 15 African countries, exports of primary products to the world comprised more than 50% of total exports of intermediate goods. This finding further highlights the critical importance of intra-African trade for industrial development, as it is well established that trade between African countries takes place at relatively more advanced levels than trade between Africa and the world.6 Both our analysis and the analysis of Foster-McGregor et al. (2015), however, find that the majority of exports of processed products are in processed industrial supplies, which generally are used in relatively simple manufacturing processes.

Composition of intra-African trade in intermediate goods. Source: Authors’ calculations from UN Comtrade (2020a and 2020b).

Overall, these findings suggest that, although limited, some capacity for trade in intermediate goods—including processed intermediate goods—may exist within Africa. In this context, rules of origin take on great importance. A balance must be struck between rules of origin that incentivize the use of domestic or intraregional intermediate inputs over those sourced from outside the continent in order to build regional value chains and prevent trade deflection, and rules of origin that impose excessive costs on exporters and thus do not stimulate regional trade. For advanced products, restrictive rules of origin may simply prevent exporters from trading under the AfCFTA because of an inability to source inputs from within the trade area. However, for more simple manufacturing processes—particularly those with high preference margins, such as textiles and clothing—rules of origin may be able to stimulate further development of regional value chains, as long as the administrative costs of compliance remain low.

4.3. Certification

In addition to sourcing qualifying inputs, the other primary costs from rules of origin come from complying with certification requirements. There are four primary certification methods used in preferential trade agreements: self-certification by exporters, certification by the exporting-country government, certification by an industry group for which the government has conferred certificating power, or a combination of these three. In general, self-certification is the least costly of these methods. As cost and bureaucratic difficulty increases for exporters, their incentives to trade under the preferential trade agreement decrease (Estevadeordal and Suominen, 2004). Furthermore, the fixed costs of certification tend to disproportionately affect SMEs with lower trade volumes and LDCs with lower customs capacity, creating large barriers to their participation in free trade areas and thus in regional value chains (UNCTAD, 2019).

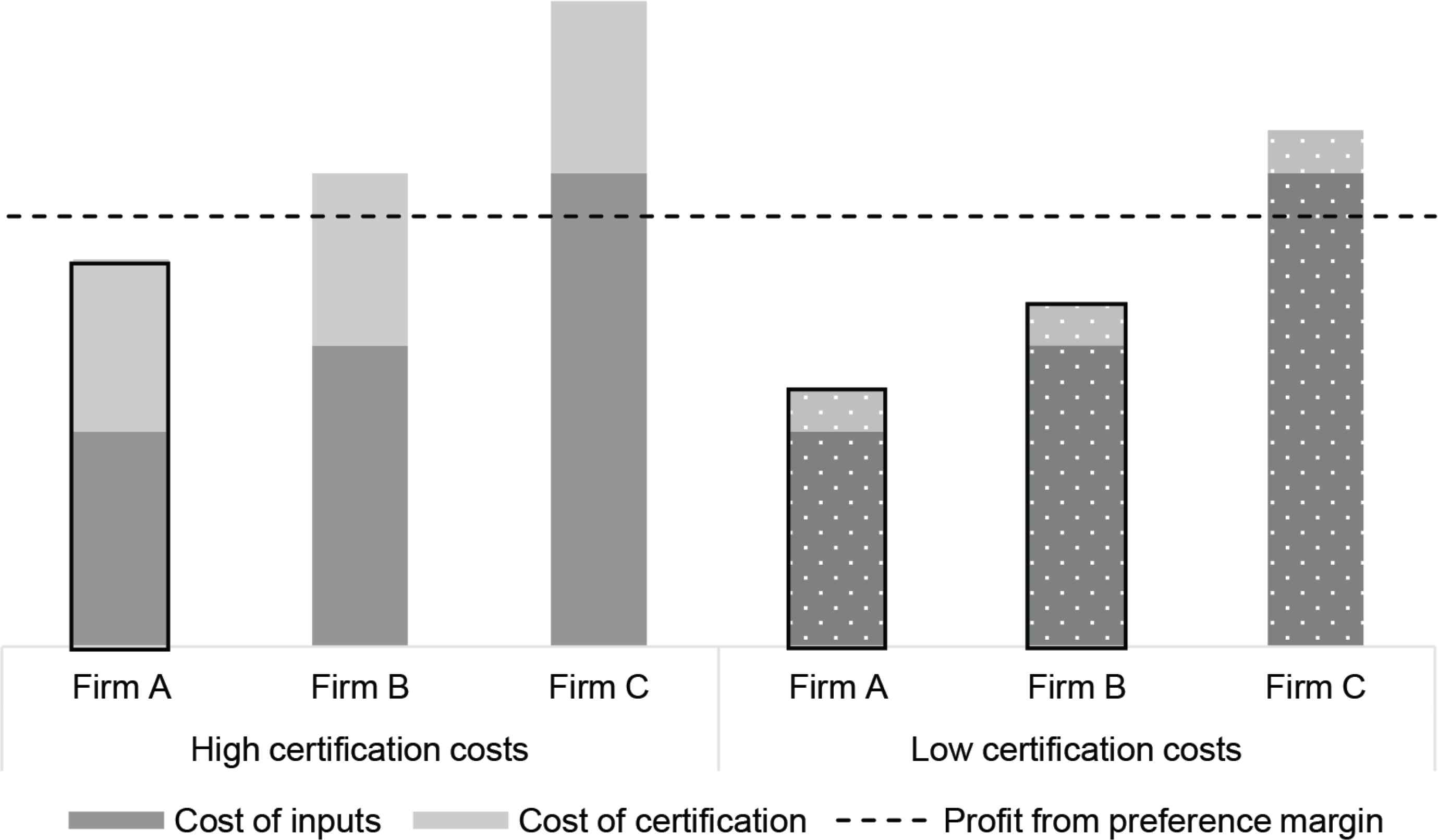

In a simplified model, as the cost of certification approaches zero, exporters will comply with rules of origin when profits from the preference margin are greater than the costs of inputs. However, when the costs of certification are high, some exporting firms’ costs may exceed their profits from trading under the AfCFTA, and they may thus cease to do so. Figure 4 shows a stylized depiction of this constraint: low certification costs result in an additional exporting firm (Firm B) trading under the AfCFTA.

Stylized effect of certification costs on trade under African Continental Free Trade Area (AfCFTA).

Among Africa’s RECs—none of which allow for self-certification—compliance with certification requirements and procedures is challenging because of the low capacity of customs authorities (UNCTAD, 2019). Muluvi et al. (2012) find that within the EAC, the procedure for obtaining a certificate of origin is difficult and lengthy, and imposes high costs on exporting firms. Similarly, Medalla and Balboa (2009) study the ASEAN AFTA and find that exporters in the Philippines and Malaysia found it costly and administratively difficult to comply with the policy of certification through a government agency. In contrast, both the U.S. African Growth and Opportunity Act and the EU Everything but Arms preferential trade agreements allow for self-certification, and self-certification is recommended by the World Trade Organization (UNCTAD, 2019). If self-certification processes are not used, it is important to ensure that certifying authorities (either public or private) are sufficiently staffed and trained to reduce administrative hurdles. Furthermore, regardless of the certification method used, requirements for certification must be clearly and simply delineated for exporters so as to reduce the difficulty and cost of compliance.

4.4. Trade Volumes

In addition to preference margins, input availability, and certification costs, Conconi et al. (2018) argue that exporters may not comply with rules of origin and use tariff preferences unless export volumes are sufficiently large to result in substantial savings from preferential trade. This may be at least a short-term issue for Africa, as intra-African trade is currently low, and high-value intra-African trade is frequently concentrated in natural resources, for which MFN tariffs are already low, limiting the benefits of preferential tariffs. We take Ghana as an example. Table 1 shows that Ghana exports nearly as many products in values below $500,000 as those in values above this dollar amount. Many of its highest-value exports—those it exports in values exceeding $20 million—are natural resources such as gold, crude petroleum oil, iron, and steel, with relatively low capacity to benefit from a preferential trade area. Of note, however, are Ghana’s high-value exports of plastics, footwear, and textiles. These sectors—particularly footwear and textiles, for which MFN tariffs are relatively high (Figure 1)—may benefit from the AfCFTA.

| Export value (millions, $) | Number of commodities | Example commodities | Number of partners | Example partners |

|---|---|---|---|---|

| >20 | 15 | Precious metals; mineral fuels; plastics; footwear; cocoa; iron and steel; beverages; textiles | 11 | South Africa, Burkina Faso, Nigeria, Senegal, Côte d’Ivoire, Niger, Egypt |

| 10–20 | 7 | Ceramic products; wood; soap; preparations of vegetables, fruits, or nuts; dairy produce | 1 | Algeria |

| 5–10 | 9 | Pharmaceutical products; aluminum; chemical products; cotton; fruit and nuts | 3 | Guinea, Liberia, Tunisia |

| 1–5 | 13 | Furniture; tools; vehicles; electrical machinery; fertilizers; rubber; feathers and down; ores | 6 | Morocco, Cameroon, Gabon, Ethiopia, Gambia, Kenya |

| 0.5–1 | 6 | Inorganic and organic chemicals; copper; coffee and tea; leather articles | 3 | Republic of Congo, Zambia, Equatorial Guinea |

| <0.5 | 45 | Glass; tobacco; apparel; aircraft; cereal; toys; sugars; arms and ammunition | 23 | Tanzania, Seychelles, Chad, Namibia, Rwanda, Uganda, Sudan, Botswana, Malawi |

Source: Authors’ calculations from UN Comtrade (2020a and 2020b).

Ghana export value by product and partner country, 2019

Table 2 shows Ghana’s export-country pairs with values in excess of $50 million. As above, we note that although the bulk of Ghana’s high-value exports are in natural resources, especially gold and crude petroleum oil, the footwear and plastics sectors have potential to benefit from reduced tariffs through a free trade area. However, in general, Ghana exports most products in low volume by country. In addition to the eight export-country pairs valued above $50 million in Table 2, Ghana has 28 export-country pairs valued between $5 and $20 million, 99 export-country pairs valued between $1 and $5 million, and 1084 export-country pairs valued below $1 million (with the majority—96%—of those valued below $500,000).

| Export | Partner | Value (millions, $) |

|---|---|---|

| Precious metals (i.e., gold) | South Africa | 1059 |

| Mineral fuels (i.e., crude petroleum oil) | South Africa | 903 |

| Footwear | Nigeria | 105 |

| Plastics | Burkina Faso | 80 |

| Plastics | Togo | 67 |

| Animal or vegetable fats and oils | Senegal | 61 |

| Plastics | Sierra Leone | 55 |

| Paper and paper articles | Burkina Faso | 50 |

Source: ROO calculations from UN Comtrade (2020a and 2020b).

Ghana’s high-value exports by partner country, 2019

With the inception of trading under the AfCFTA, intra-African trade volumes are likely to increase, rendering this issue less relevant in the long term. However, as noted above, overly restrictive rules of origin may limit increases in intra-African trade volumes by imposing costs of compliance greater than the benefits accrued to exporting firms, or by requiring the use of costly or unavailable local or regional inputs. It may thus be prudent to establish more lenient rules of origin during the early stages of trading under the AfCFTA to spur increases in intra-African trade volume and AfCFTA participation, and to later revise rules as necessary to become more restrictive as regional value chains develop on the continent.

5. THE CASE FOR PROGRESSIVE HARMONIZATION OF RULES OF ORIGIN UNDER THE AfCFTA

Both the potential benefits and the potential costs of complying with rules of origin under the AfCFTA are high. Because preference margins are relatively high for a large range of products in most African countries, exporting firms have substantial potential to profit from trading under preferential rates, rather than MFN rates. However, it will likely be difficult for many firms to source affordable intermediate inputs either domestically or from within the trade area, particularly for more advanced manufactured goods. Furthermore, the type of certification allowed for under the AfCFTA and implementation of certification processes will be a major determinant of costs, and could prove particularly burdensome for SMEs and firms in LDCs. Finally, low intra-African trade volumes reduce the incentives for exporters to comply with rules of origin, as they may not garner substantial savings from preferential tariffs.

We thus argue that in order to maximize participation under the AfCFTA, the costs of complying with rules of origin must be reduced as much as possible by introducing rules that are (1) simple, in order to reduce information and certification costs, and (2) have a relatively low value-added requirement, in acknowledgment of the difficulty and cost of sourcing qualifying intermediate inputs. The stipulation of coequal rules in Article 6 of Annex 2 is a good step toward rules that will maximize participation, as coequal rules tend to reduce costs of compliance. For example, initial adoption of the AFTA utilized a uniform rule of origin of 40% value added; this resulted in low trade preference utilization rates because of both the difficulty of satisfying the value-added requirement and the difficulty in proving that the value-added requirement had been satisfied (Haddad, 2007). Later reforms reduced the value added requirement to 20% and introduced coequal rules, with CTC as an alternative to value-added rules (Medalla and Balboa, 2009). Analysis of the AFTA has found that CTC rules are, in general, easier for both customs authorities and SMEs to understand and implement (Haddad, 2007); the use of coequal rules thus provides vital flexibility for exporting firms.

With the adoption of coequal rules, and particularly if low value-added requirements are also set, the main barrier toward simplification comes from product-specific rules enacted to retain the acquis of RECs and address the varying concerns of the heterogeneous parties to the AfCFTA. Africa’s RECs have taken different approaches to rules of origin, and every country in Africa is a member of at least one REC, with most belonging to two or more (Kimenyi et al., 2012). For instance, the Common Market for Eastern and Southern Africa (COMESA) only applies a general rule, requiring that 35% of value addition must take place within a COMESA country. The Southern African Development Community, meanwhile, also applies product-specific rules of origin (Signé and van der Ven, 2019). These rules may stay in place for intra-REC trade, and because product-specific rules of origin are typically more difficult to meet compared to general rules, exporters facing product-specific rules of origin will incur higher costs than those facing only general rules (Ibid).7

In general, the costs of complying with product-specific rules of origin are high. On a case-by-case basis, exporters must obtain information about all specific rules which apply to their products; source intermediate inputs from qualifying countries; and then document compliance, which may involve different accounting and certifying processes for different products. An examination of East Asian free trade agreements shows that product-specific rules tend to increase costs. The proliferation of free trade agreements in East Asia has created a complex and inconsistent web of rules of origin that often limits the use of trade preferences by increasing information and transaction costs (Haddad, 2007; Manchin and Pelkmans-Balaoing, 2007). In addition, multiple, overlapping, and inconsistent agreements have increased the costs of regulation to prevent trade deflection and to ensure compliance with rules of origin (Manchin and Pelkmans-Balaoing, 2007).

In this regard, to the greatest extent possible, harmonization of rules of origin across RECs and the AfCFTA is desirable. However, harmonization does not come without costs. Failure to build upon RECs’ currently existing rules of origin could disrupt supply chains as the standards for input sourcing change, add to transaction costs because of the need to realign processes with updated rules of origin, and erode competitiveness (Signé and van der Ven, 2019). It may thus be optimal for the AfCFTA to adopt product-specific rules at its inception.

In the light of these constraints, we argue that progressive harmonization of rules of origin across the continent, with the goal of gradually reducing the number of product-specific rules and moving toward the overarching application of general, coequal rules, provides the greatest opportunity to reduce compliance costs while not imposing an undue burden on exporters trading under the rules of origin of Africa’s RECs. In the schedule of the harmonization rules, negotiators should prioritize those products for which high preference margins exist—such as food products, footwear, and textiles and clothing (Figure 1)—as these products’ high potential profit margins from trading under preferential rates provide greater incentive for exporters to source inputs from domestic or regional sources, thus spurring the development of regional value chains.

In addition, it is vital that the AfCFTA’s certification costs are reduced as much as possible to maximize the number of exporters able to trade under the AfCFTA (see Figure 4). To further reduce the costs of compliance, information regarding rules of origin should be widely distributed, with, if possible, capacity-development workshops to help exporters understand compliance requirements. Improved data on African firms producing intermediate inputs would also reduce information costs, making the development of regional value chains and increased trade under the AfCFTA more likely. Finally, the use of self-certification should be explored, as it is the least costly and administratively burdensome form of certification. If self-certification is not used, it will be vital to ensure that African customs authorities have sufficient capacity to provide low-cost and administratively easy certification.

6. CONCLUSION

Rules of origin will fundamentally shape the impact of the AfCFTA on African growth and development. In this paper, we have analyzed a variety of considerations for rules of origin under the AfCFTA, including preference margins, costs of sourcing intermediate inputs, costs of certification, trade volumes, and the role of RECs. Our analysis has expanded understanding of the economic context in which they will operate, one in which preference margins for most products are high, but the costs of inputs are likewise high, and trade volumes are low. Furthermore, our examination of issues surrounding the diverse range of rules of origin used by RECs, as well as the divergent interests of large economies and LDCs, provides important political context for negotiations.

Our analysis shows that, owing to the high costs of sourcing intermediate inputs that qualify for origination, it is vital to reduce other costs of compliance with rules of origin so as to maximize the number of firms for whom the profits exceed the costs of trading under the AfCFTA at preferential rates. To build on this study, further work could analyze current levels of domestic or intra-regional value-added. An in-depth analysis of regional value chains and the costs of intermediate inputs in Africa would provide further useful context for negotiators, as would further analysis of trade volumes to determine high-potential products.

The findings from this study suggest that the AfCFTA would benefit from a progressive reduction in product-specific rules, with the goal of harmonizing rules of origin across the continent’s RECs and approaching a single, generally applied coequal rule. In addition, the adoption of self-certification process across all member countries would help to reduce costs and increase the extent of trade under the AfCFTA. By reducing the costs of compliance ROO, member countries will be better able to reap the full benefits of the AfCFTA on economic growth and development.

CONFLICTS OF INTEREST

The authors declare they have no conflicts of interest.

AUTHORS’ CONTRIBUTION

The authors contributed equally to the article.

ACKNOWLEDGMENTS

The authors are grateful to the JAT editors, Augustin Fosu and Andrew Mold. The authors also express their gratitude to anonymous reviewers as well as Witney Schneidman, Colette van der Ven, Joshua Meltzer, and Geoffrey Gertz, for their insightful comments; Brahima Coulibaly, Aloysius Ordu, and Sanjeev Khagram, for their leadership; and Christina Golubski, for her editorial work.

Footnotes

Overall, the AfCFTA is built on the principle of the preservation of acquis, which means that it builds on the RECs and maintains any levels of trade liberalization achieved in the RECs. See Article 18 (Continental Preference) of the agreement establishing the AfCFTA: “Following the entry into force of this Agreement, 1. State Parties shall, when implementing this Agreement, accord each other, on a reciprocal basis, preferences that are no less favorable than those given to Third Parties. 2. A State Party shall afford opportunity to other State Parties to negotiate preferences granted to Third Parties prior to entry into force of this Agreement and such preferences shall be on a reciprocal basis. In the case where a State Party is interested in the preferences in this paragraph, the State Party shall afford opportunity to other State Parties to negotiate on a reciprocal basis, taking into account levels of development of State Parties. 3. This Agreement shall not nullify, modify or revoke rights and obligations under pre-existing trade agreements that State Parties have with Third Parties” (African Union, 2018). Thus, we note that MFN rates do not apply between some African countries because of pre-existing RECs; however, MFN rates do apply between African countries that do not belong to the same REC, or between countries in RECs that have not signed on to the preferential trade agreement.

Excluding Eritrea, as a non-signatory to the AfCFTA, and Libya, Somalia, and South Sudan because of data availability issues.

LDCs include Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Democratic Republic of the Congo, Djibouti, Eritrea, Ethiopia, Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Niger, Rwanda, São Tomé and Príncipe, Senegal, Sierra Leone, Somalia, South Sudan, Sudan, Togo, Uganda, Tanzania, and Zambia.

Although formal intra-African trade remains low, we note that levels of informal trade are often very high between African countries. It is important to also take into consideration informal cross-border trade in Africa, and explore avenues for formalization to further boost statistics about intra-African trade.

Botswana, Comoros, Côte d’Ivoire, Egypt, eSwatini, Gambia, Ghana, Madagascar, Mauritius, Morocco, Namibia, Republic of Congo, Rwanda, São Tomé and Príncipe, Senegal, Seychelles, South Africa, Togo, Zambia, and Zimbabwe.

For example, UNECA and TradeMark East Africa (2020) illustrate these trends for the East African Community, where manufactured products represent about two-thirds of intra-regional trade, compared to only about 20% of trade with the rest of world.

Article 19 on the Establishment of the AfCFTA sets out the conflict provisions, specifying that State Parties that are Members of an REC and have attained higher levels of regional integration than under the Agreement shall maintain such levels. This statement suggests that under an REC that has liberalized 100% of tariff lines at a 0% tariff—compared to, say, 90% of tariff liberalizations under the AfCFTA—such more favorable rates apply. For rules of origin, this means that in order to receive a preferential tariff rate, exporters need to comply with the relevant rule of origin, which seems to suggest that the rule of origin that will continue to be applied in these situations is the rule of origin of the respective REC. However, in situations where the AfCFTA tariff rates are more liberal than the ones in the REC, parties are eligible to trade under these more favorable rates, provided they comply with the AfCFTA rules of origin. The complete reference of Article 19 is as follows: “Conflict and Inconsistency with Regional Agreements 1. In the event of any conflict and inconsistency between this Agreement and any regional agreement, this Agreement shall prevail to the extent of the specific inconsistency, except as otherwise provided in this Agreement. 2. Notwithstanding the provisions of Paragraph 1 of this Article, State Parties that are members of other RECs, regional trading arrangements and custom unions, which have attained among themselves higher levels of regional integration than under this Agreement, shall maintain such higher levels among themselves” (African Union, 2018).

REFERENCES

Cite this article

TY - JOUR AU - Landry Signé AU - Payce Madden PY - 2020 DA - 2020/12/11 TI - Considerations for Rules of Origin under the African Continental Free Trade Area JO - Journal of African Trade SP - 77 EP - 87 VL - 8 IS - 2 (Special Issue) SN - 2214-8523 UR - https://doi.org/10.2991/jat.k.201205.001 DO - 10.2991/jat.k.201205.001 ID - Signé2020 ER -